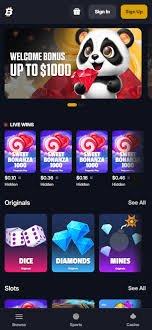

In recent years, cryptocurrencies have revolutionized the financial landscape, leading to an unprecedented interest in how payments are processed within this digital ecosystem. As the cryptocurrency market grows, the need for a robust Payment Stack Architecture becomes paramount to ensure that transactions are secure, efficient, and user-friendly. This article delves into the complexities of Payment Stack Architecture for crypto, its components, advantages, and the challenges that lie ahead, as well as how it relates to various applications, including Payment Stack Architecture for Crypto Casinos betting on Bitfortune.

Understanding Payment Stack Architecture

Payment Stack Architecture refers to the framework that enables the processing of payment transactions, encompassing various layers and components. In the context of cryptocurrency, this architecture must accommodate the decentralized nature of blockchain technology, while ensuring scalability, speed, and security.

Components of Payment Stack Architecture

The Payment Stack Architecture for cryptocurrencies typically consists of the following crucial components:

- Wallets: Digital wallets serve as user interfaces for managing cryptocurrencies, allowing users to store, send, and receive digital assets. They can be software-based (mobile apps or desktops) or hardware-based (physical devices).

- Payment Gateways: These act as intermediaries that facilitate the transaction process between the merchant and the user. They convert crypto payments into fiat currencies when necessary and vice versa.

- Blockchain Networks: The backbone of cryptocurrency payments rests on blockchain technology, which acts as a decentralized ledger that verifies and records transactions. Different cryptocurrencies operate on various blockchains, with protocols specific to their use cases.

- Smart Contracts: Smart contracts are self-executing contracts with the terms of the agreement directly written into the code. They automate and secure transactions, eliminating the need for intermediaries.

- Regulatory Compliance Components: To operate legally, payment systems must comply with regulations such as Know Your Customer (KYC) and Anti-Money Laundering (AML) laws, which assess the legitimacy of users and transactions.

The Benefits of a Structured Payment Stack

Implementing a comprehensive Payment Stack Architecture for cryptocurrencies offers numerous benefits:

- Enhanced Security: Through the use of blockchain technology, transactions are securely recorded and immutable, reducing the risk of fraud.

- Lower Transaction Costs: Cryptocurrencies can eliminate the fees associated with traditional banking and card processing, resulting in cost savings for both merchants and consumers.

- Increased Transaction Speed: Many cryptocurrencies enable near-instant transactions, unlike traditional banking systems that may take several days to process.

- Global Reach: Cryptocurrencies operate globally, allowing users to transact without the barriers typically imposed by currency exchange and banking regulations.

Challenges in Payment Stack Architecture

Despite its advantages, the Payment Stack Architecture for cryptocurrencies also faces several challenges:

- Volatility: The inherent volatility of cryptocurrencies can lead to unstable prices during the transaction process, posing risks for merchants and consumers alike.

- Regulatory Hurdles: As governments worldwide work to enact regulations for cryptocurrencies, compliance can be cumbersome and costly for businesses.

- Adoption Barriers: Lack of understanding about cryptocurrencies and how to use them can deter consumers from adopting these new payment methods.

- Scalability Issues: As transaction volumes increase, blockchain networks may face challenges in processing speed and capacity, leading to potential delays.

Future Outlook for Payment Stack Architecture

As the cryptocurrency landscape continues to develop, the Payment Stack Architecture is poised to evolve as well. Below are trends that may shape its future:

- Layer 2 Solutions: Innovations such as the Lightning Network for Bitcoin and similar solutions for other cryptocurrencies aim to enhance transaction speeds and reduce fees by processing transactions off the main blockchain.

- Integration with Traditional Finance: The blending of cryptocurrencies with traditional financial systems is likely to create a more seamless payment experience for consumers.

- Increased Decentralization: As blockchain technology matures, we can expect an increase in decentralized payment systems that may reduce reliance on intermediaries.

Conclusion

The Payment Stack Architecture for cryptocurrency represents a significant step towards reshaping the financial landscape. As users become more comfortable with digital assets, and as businesses continue to adopt crypto payment systems, the architecture must adapt to address security, scalability, and compliance. By navigating the inherent challenges and leveraging the advantages, the future of cryptocurrency payments looks promising, potentially transforming industries including e-commerce, betting, and beyond.

Understanding this architecture is crucial for stakeholders aiming to innovate within the crypto space and capitalize on the opportunities it presents. The evolution of Payment Stack Architecture signifies not just the future of payments, but a shift towards a more decentralized and inclusive financial system.